When considering weight loss surgery, one of the most pressing questions on many people’s minds is, “Does insurance cover weight loss surgery?”

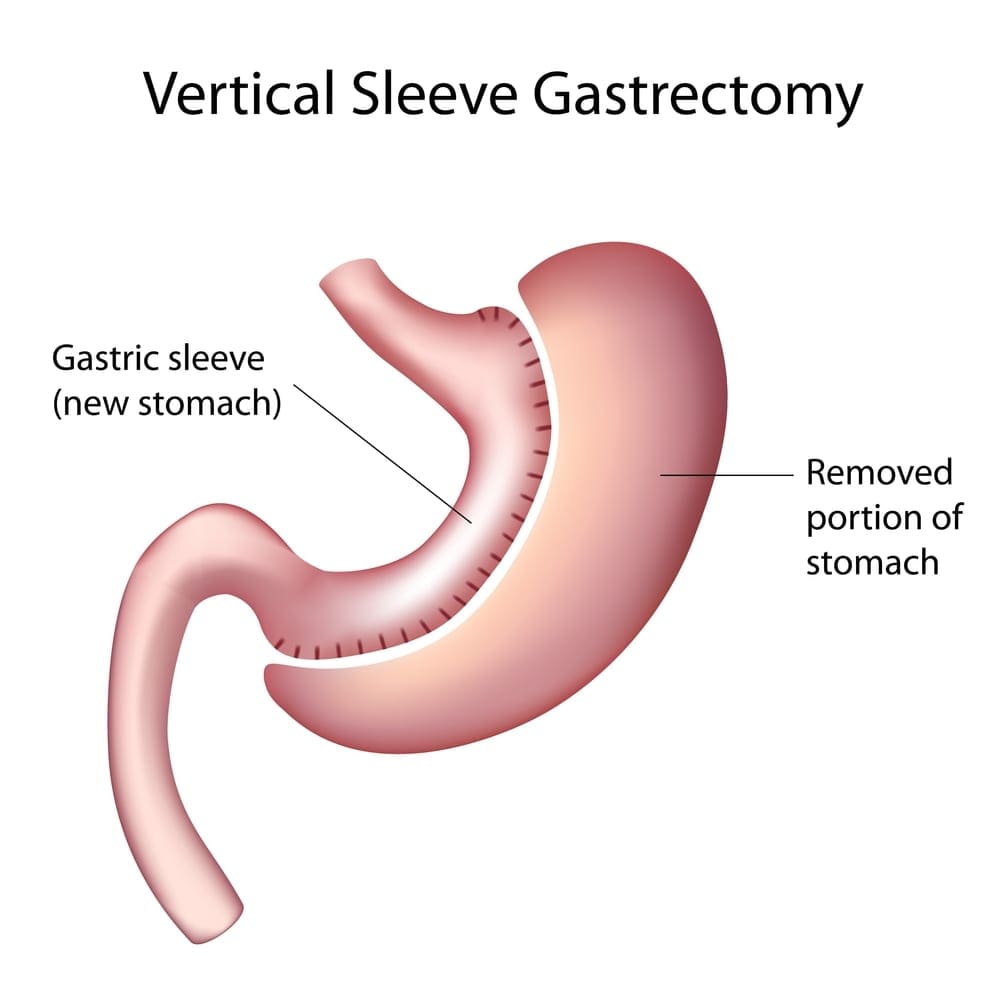

As obesity rates continue to climb globally, weight loss surgeries such as gastric bypass, lap band, and gastric sleeve procedures have become critical tools in managing severe obesity and related health conditions. These surgeries help reduce weight and improve various obesity-related health issues like diabetes, hypertension, and sleep apnea, highlighting their medical necessity.

Given the significance and potential health benefits of these procedures, understanding insurance coverage is essential for anyone considering surgical options for weight management. This article will explore whether insurance covers weight loss surgeries, reviewing the specifics of coverage, requirements, and how to handle potential denials.

How Much Does Weight Loss Surgery Cost?

Before we examine whether insurance covers bariatric surgery, we should discuss the associated costs. The cost of weight loss surgery ranges into the tens of thousands of dollars and can extend well beyond the initial surgical procedure. Typically, these costs include:

- Surgical fees

- Hospital charges for the room and nursing care during the stay

- Anesthesia fees

- Expenses related to post-operative follow-up care, which is crucial for monitoring recovery and ensuring the success of the surgery

In addition to these direct surgical costs, patients must also consider additional expenses that are often not covered by insurance. For instance, most weight loss surgery patients require ongoing nutritional counseling to help them adapt to their new dietary requirements and ensure they receive adequate nutrition.

Many patients also must take lifelong supplements, such as vitamins and minerals, to compensate for the reduced ability to absorb nutrients following procedures like gastric bypass. These supplements and the cost of dietary consultations can represent a significant part of the post-surgery expenses.

Understanding these costs is vital, as they impact your overall investment in your health and well-being.

Although insurance charges vary greatly depending on each contract, JourneyLite believes in transparent pricing for self-pay patients and provides a comprehensive outline of your overall costs so you can clearly understand your financial obligation. For insurance patients, our team can estimate your out-of-pocket expenses once we analyze your policy and coverage benefits.

Does Insurance Cover Weight Loss Surgery?

The short answer is “sometimes.” Certain insurance plans will cover weight loss surgery if it’s deemed medically necessary. This may include insurance coverage for gastric sleeve, lap band, or gastric bypass procedures.

Significant Differences in Coverage

Weight loss surgery coverage can vary significantly among different providers and plans. But many health insurance policies commonly cover several aspects of weight loss procedures. Typically, insurance will cover the major expenses of the surgery itself, including hospital stays, surgeon’s fees, and anesthesia, provided that the surgery is deemed medically necessary. This determination of medical necessity usually requires documentation from healthcare professionals indicating that the surgery is essential for the treatment of obesity-related health conditions that could be life-threatening if left untreated.

Varying Coverage for Procedures

The extent of coverage can differ significantly. Some insurance companies may cover all types of weight loss surgeries. In contrast, others might only cover specific procedures like gastric bypass or sleeve, excluding others such as adjustable gastric banding. Additionally, coverage might include all associated hospital charges for the duration of the stay required by the surgical procedure, but this, too, can vary. Each insurance provider has its own criteria for eligibility and coverage, including different deductible levels, co-payments, and out-of-pocket maximums that can affect your overall cost.

The Need for Reviewing Coverage

Patients considering weight loss surgery should closely review their insurance plan or speak directly with their insurance provider to understand what is covered. Our team of professionals can also help you determine what is covered. Reviewing your coverage is essential for financial planning and to ensure there are no surprises during the billing process after the surgery has been completed.

Insurance Coverage Requirements for Weight Loss Surgery

Although each plan differs, securing insurance coverage for weight loss surgery often involves meeting a set of stringent criteria established by insurance companies. One of the primary requirements is related to body mass index (BMI). Typically, insurance providers require a BMI of 40 or higher, which indicates severe obesity. Alternatively, a person with a BMI of 35 to 39.9 may also qualify if they have significant obesity-related health conditions, such as hypertension, type 2 diabetes, or severe sleep apnea.

Additional Documentation

Beyond BMI, insurance companies usually require documented evidence of weight-related health issues that could improve with surgery and a history of previous weight loss attempts through non-surgical methods like diet, exercise, and perhaps medical therapy, proving that other methods have been ineffective over a significant period. This documentation often includes detailed medical records, a physician’s recommendation, and sometimes a psychological evaluation to assess the patient’s mental readiness and support system for post-surgery lifestyle changes.

Preoperative Testing

Additionally, prospective patients are typically required to undergo several preoperative medical assessments to ensure they are fit for surgery. These assessments might include lab tests, heart and lung evaluations, and consultations with nutritionists and psychologists. Gathering and presenting this comprehensive documentation is crucial to demonstrate the necessity of the surgery and facilitate the approval process with your insurance provider.

What Insurance Companies Cover Weight Loss Surgery?

Many major insurance companies provide coverage for weight loss surgery, but the specifics of this coverage differ based on state regulations and individual policies. Examples of health insurance plans accepted by JourneyLite include:

- Aetna

- Anthem/Blue Cross-Blue Shield

- Cigna

- Humana

- Medical Mutual

- Surgery Plus

- Transcarent

- United Healthcare

Our expert patient service representatives can help you explore your options and provide useful tips for pursuing insurance coverage for your weight loss surgery.

What To Do if Your Claim Is Denied

If your insurance claim for weight loss surgery is denied, it’s essential to understand that you can appeal the decision. Initially, you should request a detailed explanation of the denial from your insurance provider. This information is crucial as it will guide your next steps and help you address specific reasons cited for the denial.

Review the Denial Letter

Carefully read the denial letter to understand why your claim was rejected. Look for any errors or misunderstandings regarding your medical information or the insurance policy’s criteria.

Gather Additional Documentation

Collect further medical evidence that supports the necessity of the surgery. This could include more detailed letters from your healthcare providers, new medical test results, and records of your ongoing health conditions.

Formal Appeal

Submit an official appeal to your insurance company. This typically involves filling out an appeal form provided by your insurer and attaching all relevant documentation to strengthen your case. Be sure to adhere to any deadlines and procedural requirements specified by your insurance plan.

Be Proactive and Organized

By taking these steps, you increase your chances of having your appeal accepted and become more informed about your insurance plan and its processes. It’s essential to be proactive, organized, and persistent when appealing a denial, as this can significantly affect whether you receive the treatment you need.

Insurance Coverage Alternatives

If your appeal is denied, don’t lose hope. We offer several financing options to help you meet your goal. You can find financing plans through Kemba Financial Credit Union, CareCredit, and Prosper Healthcare Lending. Flexible savings accounts (FSAs) and health savings accounts (HSAs) also can be used to pay for a portion of your surgery.

Frequently Asked Questions About Weight Loss Surgery

As a leading weight loss surgery provider, JourneyLite has a wealth of knowledge to share. Read the following question for the answers you’ve been looking for.

How Do People Afford Weight Loss Surgery?

Many insurance companies cover weight loss surgery under specific circumstances. If your plan doesn’t cover your procedure, we offer several financing options to help you afford it.

What Types of Weight Loss Surgery Are Typically Covered by Insurance?

Insurance typically covers surgeries deemed medically necessary, such as lap band and gastric bypass or sleeve procedures. Coverage can vary by provider, so it’s essential to check with your insurance company for specifics.

How Do I Know if My Insurance Covers Weight Loss Surgery?

To determine if your plan covers weight loss surgery, review your insurance policy’s benefits booklet or contact your insurance provider directly. You can also speak with one of our knowledgeable representatives, who can help clarify coverage details.